Each year when you file your income tax returns, your attention understandably is focused on the total amount of money you paid in taxes. This often includes taxes paid to the federal government as well as to the state government. It is common for some individuals to pay 18 or 20 percent or more of their gross income in income taxes, and you understandably want to reduce this financial burden, if possible. This is such a tremendous sum of money that you may even be thinking about relocating to a state that does not have a state income tax to save money. While this may seem ideal at first, a closer look at this option can be revealing.

How States Raise Money

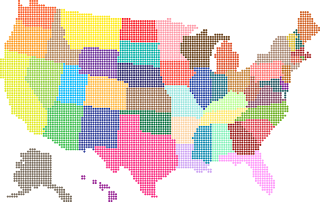

All states have a complicated taxation system to raise revenue. State taxes are allocated for roads and infrastructure, police and fire services, education and much more. These mostly add to your quality of life in different ways. Some states with a lower overall tax burden on residents may have a higher crime rate, lower quality schools and other consequences as a result. Some states rely heavily on a personal income tax for revenue, but they also may use property taxes, sales taxes, hospitality taxes, lottery earnings and more to fund state programs. Generally, a state that does not have an income tax may have a higher sales and property tax rate to compensate for it. However, because states have various levels of funding for different programs, some states have a higher or lower overall tax burden than others.When a State Without Income Tax is Cost-Effective

A state income tax only affects those who are earning income. Some states have a flat tax, and others have a graduated taxation system that taxes higher income individuals more heavily. Generally, if you are not earning an income or if you have a very low income, it may be more cost advantageous to live in a state with an income tax. If you are a higher wage earner, living in a state without an income tax may be advantageous. However, keep in mind that the state may tax you in other ways, such as through property and sales tax. Therefore, the state is still generating money off of you.Paying taxes to the state is a veritable requirement for most people regardless of where you live. You may review your financial situation and spending habits to determine if it is more advantageous to live in a state with a higher income tax rate versus a higher sales tax or property tax rate.

William Doonan is a tax law and legal expert in New York.

No comments:

Post a Comment